montana sales tax rate change

For Alcoholic Beverage Taxes please select the tax type below. Lodging Facility Sales and Use Tax Guide Page 1 What is the Lodging Facility Sales and Use Tax.

States Without Sales Tax Article

The tax rate for residential property is 135 percent in 2018.

. Senate Bill 399. Tax rate of 1 on the first 3300 of taxable income. The highest tax rate will decrease from 69 to 675 on any taxable income over 19800.

Change in a substantial way then the prior years reappraisal value is also used in the even-numbered tax years. 368 rows There are a total of 68 local tax jurisdictions across the state collecting an average. Montana tax forms are sourced from the Montana income tax forms page and are updated on a yearly basis.

There are two taxes imposed on users of an overnight lodging facility. Montana additionally imposes some special taxes in resort. The bill will eliminate 23 tax credits in the process.

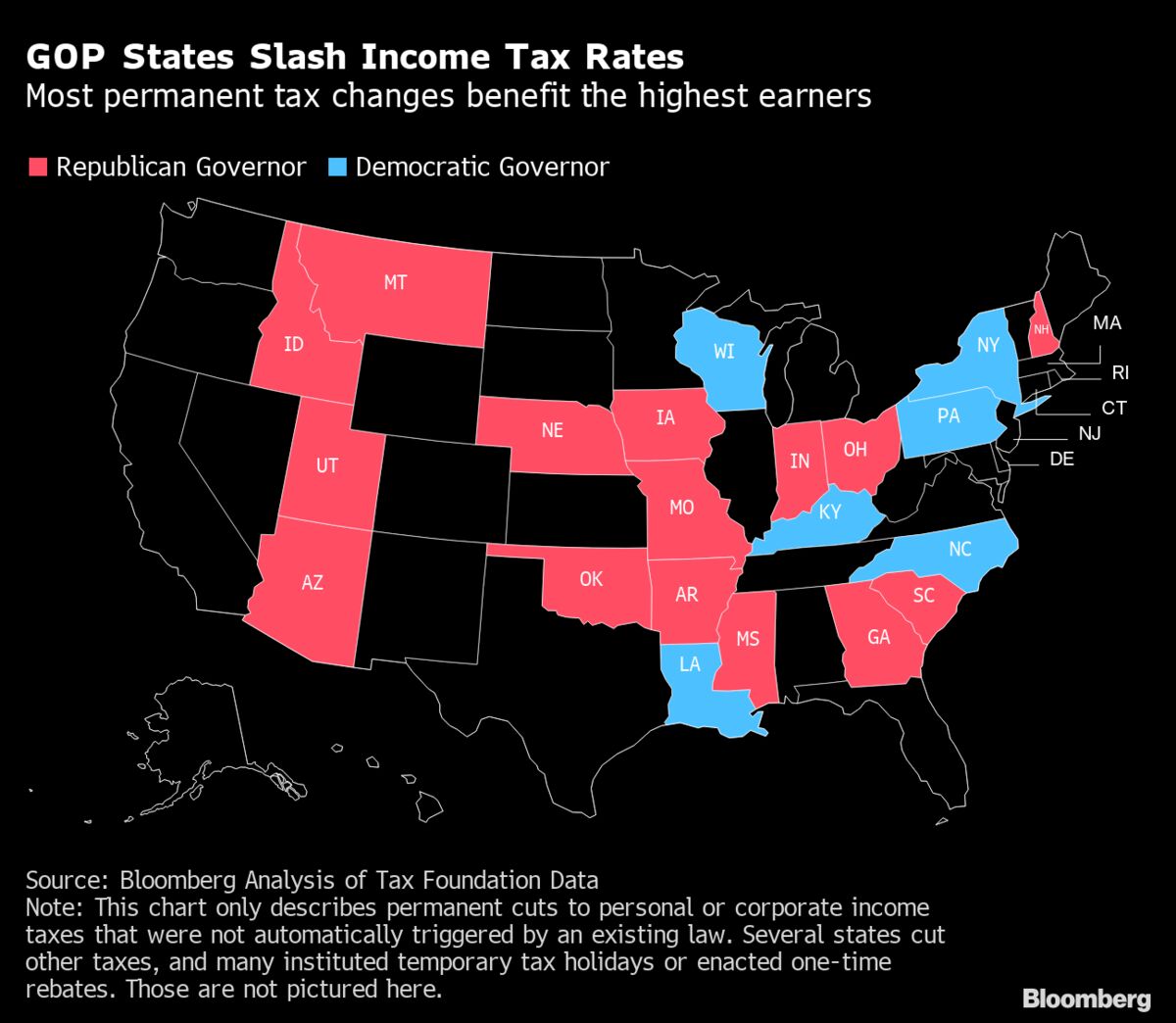

Montana currently has seven marginal tax rates. Gianforte tax reform changes. The recent Montana tax reform package made several changes to individual and corporate taxes.

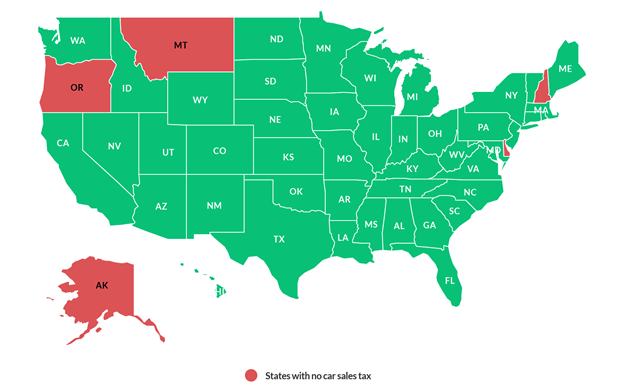

The 2022 state personal income tax brackets are updated from the Montana and Tax Foundation data. Some changes go into effect in Tax Year 2022 which we detailed in an earlier Tax News You Can Use article. Montana is one of the five states in the USA that have no state sales tax.

Tax rate of 2 on taxable income between 3301 and 5800. Sales tax rates for items like food and telecommunications are lower than. Before the official 2022 Montana income tax rates are released provisional 2022 tax rates are based on Montanas 2021 income tax brackets.

Download the latest list of location codes and tax rates. Fast Easy Tax Solutions. I know they probably take a lot of grief but I wanted to give a Good Job to your Call Center.

There are additional taxes on tourism-related businesses such as hotels and campgrounds 7. Department of Revenue Call Center. Download our Tax Rate Lookup App to find Washington sales tax rates on the go wherever your business takes you.

These two taxes are a 4 Lodging Facility Use Tax see 15-65-101 MCA through 15-65-131 MCA. Learn more about the Gov. The legislature provides three programs to.

Previous or current calendar year. They are always kind and efficient. But keeping up with filing deadlines and continually being aware of nexus threshold changes makes sales tax.

The first day of the month following 30 days from adoption by the city or borough. Vehicle owners to register their cars in Montana. You can learn more about licensing and distribution from the Alcoholic Beverage Control Division.

While Montana has no statewide sales tax some municipalities and cities especially large tourist destinations charge their own local sales taxes on most purchases. Over the past year there have been 98 local sales tax rate changes in Missouri. The 16 credits are repealed effective tax year 2022 while the rest of the changes are not effective until 2024 tax.

Cutting income taxes was a top goal for the governor this legislative session as part his Comeback Plan aimed at boosting the states economy. The tax rate for commercial and industrial property is 14 times the residential property tax rate or 189 percent in 2018. This bill is subject to the ARPA Savings Clause.

However most changes take place in tax year 2024. The bill did not affect the six lowest marginal rates. The majority of states45 and the District of Columbia as of July 2021impose a sales tax at the state level.

Montana does not levy a sales tax so there is no requirement for remote sellers to collect and remit it. Ad Find Out Sales Tax Rates For Free. ARM 4214101 through ARM 4214112 and a 4 Lodging Sales Tax see 15-68-101 MCA.

We can also see the progressive nature of Montana state income tax rates from the lowest MT tax rate bracket of 1 to the highest MT tax rate bracket of 675. Distillery Excise and License Tax. This reduction begins with the 2022 tax year.

Simplification of Montana Income Taxation. Only Oregon Montana New Hampshire Alaska and Delaware dont tax sales as of 2021 but Alaska allows local counties and municipalities to levy sales taxes of their own. The Montana Department of Revenue administers the states licensing distribution and taxation on Alcoholic Beverages.

Because there is no sales tax in the state and several counties also do not levy a local option tax the cost of registering luxury vehicles here as opposed to other states that may have registration fees sales tax and local taxes is significantly lower. Therefore the rate can revert to the current highest. Senate Bill 399 passed during the 67 th Montana Legislative Session made several changes to Montanas income tax system.

And 100000 in 2021 and thereafter. State and Local Sales Tax Rates. Look up a tax rate on the go.

Just tap to find the rate Local sales use tax. For single taxpayers living and working in the state of Montana. Gianforte signed another companion bill that cuts taxes for the top marginal tax rates from 69 to 675 in 2022 and then to 65 in 2024.

This page will be updated monthly as new sales tax rates are released. Our mobile app makes it easy to find the tax rate for your current location. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply.

The Call Center always does a good job helping when I call for assistance with my tax return. From 500000 down to 100000. Alaska Remote Seller Sales Tax Commission Economic Nexus Rules.

The tax applies to charges paid for the use of the facility for lodging and does not apply to charges for. 4214101 ARM through 4214112 ARM and a 3 lodging facility sales tax see 15-68-101 MCA through 15-68-820 MCA for a combined 7 lodging facility sales and use tax.

Gas Taxes Rise In A Dozen States Including An Historic Increase In Illinois Itep

Pennsylvania Sales Tax Small Business Guide Truic

Is Buying A Car Tax Deductible Lendingtree

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

Ci 121 Montana S Big Property Tax Initiative Explained

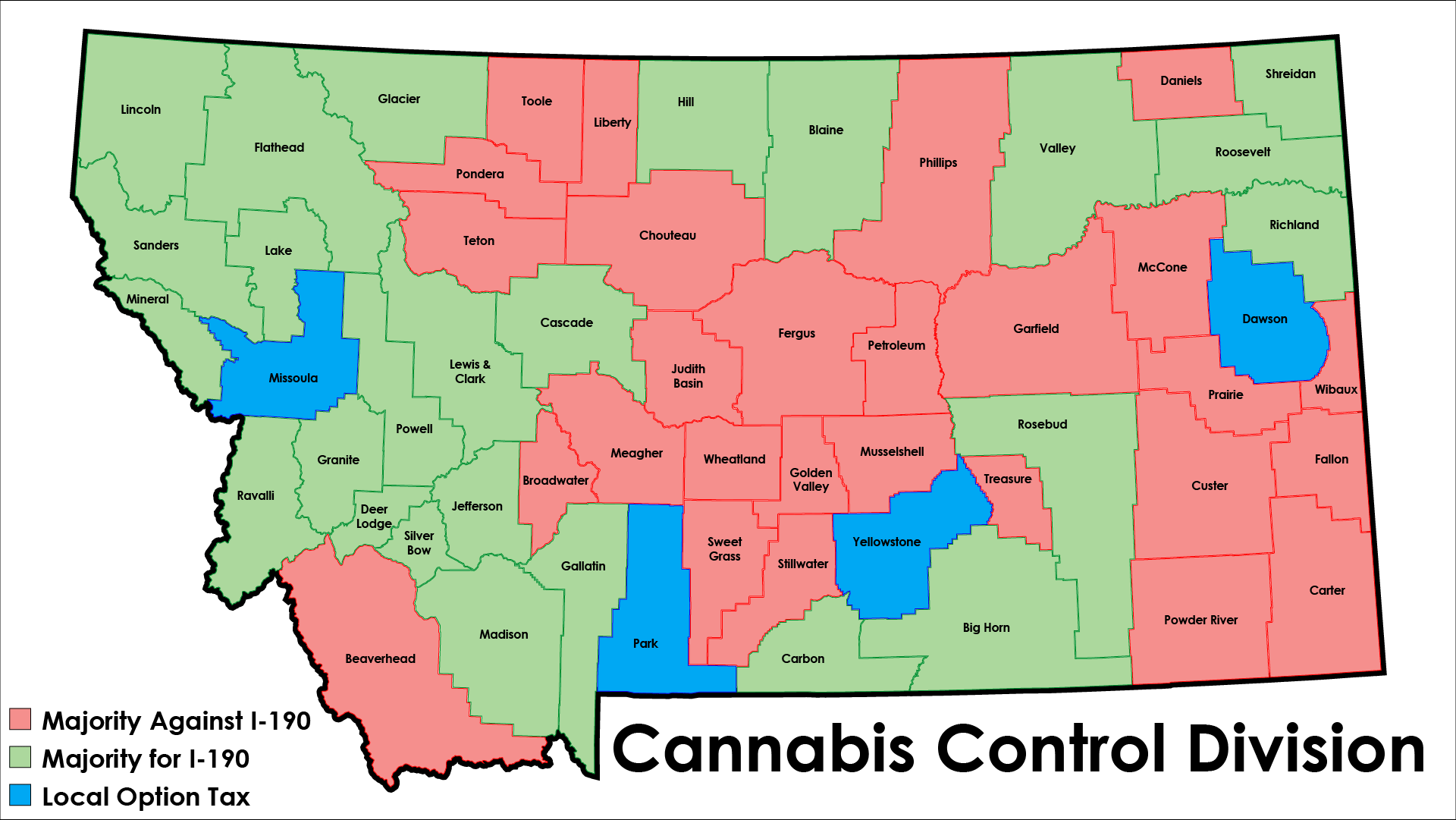

Cannabis Control Division Frequently Asked Questions Montana Department Of Revenue

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Montana Sales Tax Rates By City County 2022

How To Charge Your Customers The Correct Sales Tax Rates

How Do State And Local Sales Taxes Work Tax Policy Center

States Without Sales Tax Article

Montana State Taxes Tax Types In Montana Income Property Corporate

Montana State Taxes Tax Types In Montana Income Property Corporate

States Without Sales Tax Article

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Montana State Taxes Tax Types In Montana Income Property Corporate